A PAN (Permanent Account Number) Card is essential for filing Income Tax Returns in India. It’s crucial to ensure that all information on the card is up-to-date and accurate. This article will guide you through the steps to update or correct your PAN Card details, both online and offline, using the services of NSDL (National Securities Depository Limited) and UTIITSL (UTI Infrastructure Technology and Services Limited). Keeping your PAN Card information current is vital for smooth tax-related processes.

Inaccurate information on your PAN card can cause complications in the future. Therefore, it’s recommended to rectify any errors or inconsistencies in your PAN details as quickly as possible. You have the option to update or modify various details, including your name, date of birth, photograph, signature, father’s name, Aadhaar number, gender, address, and contact information. Taking prompt action to correct these details can help avoid potential issues down the line.

The PAN (Permanent Account Number) is of utmost importance in India, serving not only for Income Tax purposes but also as a crucial form of identity proof. Any errors in your PAN information can potentially cause problems in the future. Therefore, it’s strongly recommended to rectify any mistakes or inaccuracies in your PAN details as promptly as possible. Taking quick action to correct these errors can help prevent future complications and ensure the smooth use of your PAN for various official purposes.

How to Update PAN Card Online :

You can easily update or correct the information on your PAN card by following these steps :

Step 1 : Visit the official NSDL E-Governance website at www.tin-nsdl.com.

Step 2 : Under the Services Section, click on “PAN”.

Step 3 : Click “Apply” in the “Change/Correction in PAN Data” section.

Step 4 : From the ‘Application Type’ dropdown menu, select ‘Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)’.

Step 5 : In the ‘Category’ dropdown menu, select the appropriate category (e.g., ‘Individual’ for personal PAN).

Step 6 : Enter your name, date of birth, email address, and mobile number.

Step 7 : Fill in the Captcha and click “Submit”.

Step 8 : You’ll receive a Token Number via email. Click the button to continue the process.

Step 9 : On the next page, choose “Submit scanned images through e-Sign on NSDL e-gov”.

Step 10 : Fill in details like father’s name, mother’s name (optional), and Aadhaar number. Click ‘Next’.

Step 11 : Update your address on the following page.

Step 12 : Upload required documents (proof of address, age, identity, and PAN).

Step 13 : Sign the declaration and click “Submit”.

Step 14 : Make the payment using demand draft, net banking, or credit/debit card.

Step 15 : Print the generated acknowledgement slip. Send it to the NSDL e-gov office with physical proof documents. Affix two photographs, sign across them, and write ‘Application for PAN Change’ with the acknowledgement number on the envelope.

NSDL Mailing Address :

NSDL e-Gov at Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411 016′

Note: You have to pay the fee for the correction or update of your PAN details as applicable.

How to Update PAN Card Offline :

To apply for a PAN Card correction or update using the offline method, please follow these steps :

Step 1 : Download the form for requesting a new PAN card or making changes/corrections to existing PAN data.

Step 2 : Carefully complete all required fields in the form.

Step 3 : Gather and attach the necessary supporting documents, including :

- Proof of identity

- Proof of address

- Passport-sized photographs

Step 4 : Submit the completed form and documents at your nearest NSDL collection center.

Step 5 : Pay the applicable fees for PAN card update or correction at the center.

Step 6 : You will receive a 15-digit acknowledgement number. Use this number to track the status of your PAN card application.

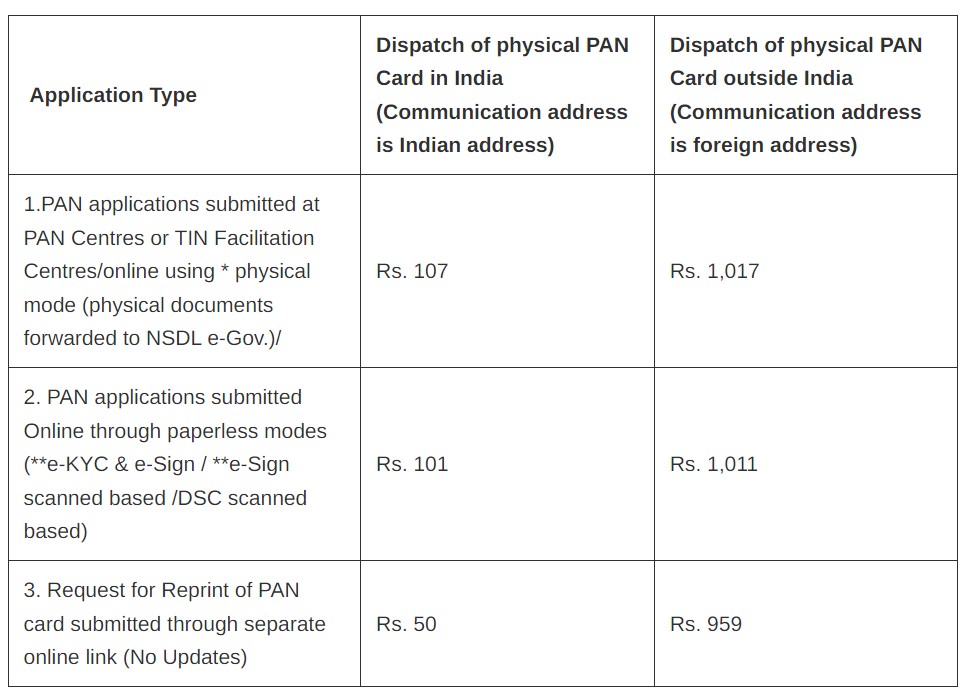

Fees and Charges for PAN Card Update :

Note: * Additional UIDAI charges as notified by UIDAI for Aadhaar Authentication services would be levied along with applicable tax in case of PAN applications submitted online using physical mode.

** Additional UIDAI charges and e-Sign charges as notified by UIDAI for Aadhaar e-KYC and Aadhaar Authentication services would be levied along with applicable tax in case of e-KYC along with e-Sign and e-Sign scanned based PAN application.

How to Change Name in PAN Card Online :

- You can submit online applications through TIN-NSDL or UTIITSL websites.

- For online applications, pay using a debit card, credit card, or net banking.

- You’ll receive a 15-digit acknowledgement number to check your PAN card status.

- After successful submission, you should receive your updated PAN card within 45 days.

To apply, visit the official NSDL E-Governance website at www.tin-nsdl.com.

- PAN cards do not display the cardholder’s address.

- The address you provide is used to mail your physical PAN card. To update your address, submit an offline correction form 49A.

- For online forms verified with Aadhaar OTP, you can’t change the address directly. The system uses the address in your Aadhaar database.

- If you need to change this address, first update it on your Aadhaar card, then submit PAN Card Form 49A again.

| Apply For New PAN Card | Click Here |