To apply for your PAN online, you have two options: the NSDL portal or the UTIITSL portal. Once you visit either of these portals’ official websites, you will need to fill out either Form 49A (for Indian citizens) or Form 49AA (for non-Indian citizens). To get started, follow the steps below after logging in to either the NSDL or UTIITSL web portal.

Apply for PAN Card through NSDL Portal

The government has made provisions for applicants to apply for PAN through the Income Tax PAN Services Unit of NSDL. Follow these easy steps to apply for a PAN online:

Step 1: Open the NSDL site (https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html) to apply for a new PAN.

Step 2: Select the Application type – New PAN for Indian citizens, foreign citizens or for change/correction in existing PAN data.

Step 3: Select your category – individual, associations of persons, a body of individuals, etc.

Step 4: Fill in all the required details like name, date of birth, email address and mobile number in the PAN form.

Step 5: On submitting the form, you will get a message regarding the next step.

Step 6: Click on the “Continue with the PAN Application Form” button.

Step 7: You will be redirected to the new page where you have to submit your digital e-KYC.

Step 8: Select whether you need a physical PAN card or not and provide the last four digits of your Aadhaar number.

Step 9: Enter your personal details, contact and other details in the next part of the form.

Step 10: Enter your area code, AO Type, and other details in this part of the form. You can also find these details in the tab below

Step 11: The last part of the form is the document submission and declaration.

Step 12: Enter the first 8 digits of your PAN card to submit the application. You will get to see your completed form. Click Proceed if no modification is required.

Step 13: Select the e-KYC option to verify using Aadhaar OTP. For Proof of Identity, Address and Date of Birth, select Aadhaar in all fields and click on Proceed to continue.

Step 14: You will be redirected to the payment section where you have to make payment either through demand draft or through net banking/debit/credit card.

Step 15: A payment receipt will be generated on successful payment. Click on “Continue”.

Step 16: Now for Aadhaar Authentication, tick the declaration and select the “Authenticate” option.

Step 17: Click on “Continue with e-KYC” after which an OTP will be sent to the mobile number linked with Aadhaar.

Step 18: Enter the OTP and submit the form.

Step 19: Now click on “Continue with e-Sign” after which you will have to enter your 12-digit Aadhaar number. An OTP will be sent to the mobile number linked with Aadhaar.

Step 20: Enter OTP and submit the application to get the Acknowledgement slip in pdf having your date of birth as the password in DDMMYYYY format.

Apply for PAN Card through UTIITSL Portal

Step 1: Visit the official website of UTIITSL.

Step 2: Click on the ‘New PAN’ option.

Step 3: Select the ‘PAN card Form 49A ’, regardless of whether you are an Indian citizen, NRE/NRI, or OCI.

Step 4: Enter all of the requested information in the form.

Step 5: Pay the required fee online or via a demand draft.

Step 6: An acknowledgement slip that includes the 15-digit acknowledgement number will be created.

Step 7: Within 15 days of submitting Form 49A online, send the supporting documentation to the UTIITSL office or use Aadhaar OTP authentication to e-sign your application.

Step 8: The PAN number will be verified after the acknowledgement form is sent to the relevant office.

Step 9: Following the UTIITSL PAN verification, the PAN number will be verified, and the card will be generated.

Step 10: You will receive your PAN card on your address within 15 days.

How to Check Pan Card Application Status

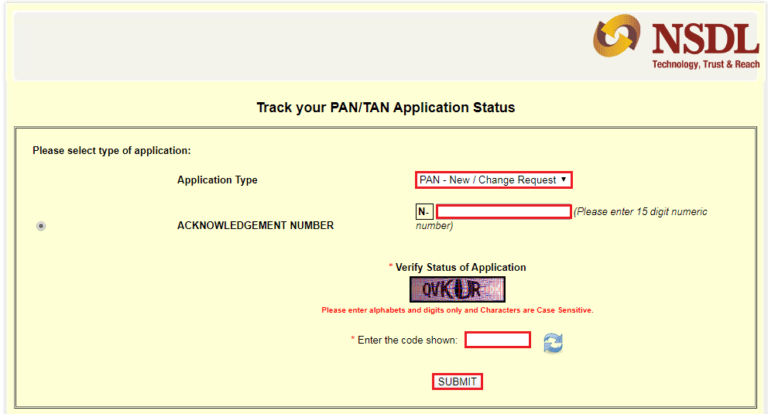

- Visit the Official PAN Application Status Portal:

- Go to the official PAN application status portal provided by the Income Tax Department of India. You can access this portal at https://tin.tin.nsdl.com/pantan/StatusTrack.html.

- Select the Application Type:

- On the PAN application status page, select the appropriate application type based on your status:

- “Application Type”: For individual applicants, select “New PAN – Indian Citizen (Form 49A).”

- For foreign citizens, select “New PAN – Foreign Citizen (Form 49AA).”

- On the PAN application status page, select the appropriate application type based on your status:

- Enter the Acknowledgment Number:

- Enter the 15-digit acknowledgment number that was provided to you when you submitted your PAN card application. This number is essential for tracking your application status.

- Double-check that you enter the acknowledgment number correctly to avoid any errors.

- Security Code:

- Enter the security code displayed on the page. This code helps verify that you are not a robot.

- Submit the Details:

- After entering the acknowledgment number and security code, click on the “Submit” or “Track Status” button.

- View the Status:

- The next page will display the status of your PAN card application. It will indicate whether your application is under processing, dispatched, or any other relevant status.

- Additional Information:

- If your PAN card application status indicates that it has been dispatched, you may also find information on the dispatch date and the courier or postal service used to send the PAN card.

- Print or Save the Status:

- You can print or save the application status for your records.

Please note that it may take some time for your PAN card application status to be updated, especially during peak application periods. Be patient and regularly check the status using the acknowledgment number provided to you during the application process.