ICICI Bank is a leading provider of personal loans in India, offering competitive interest rates starting at 10.85% p.a. and flexible tenures of up to 6 years. With loan amounts of up to ₹50 lakh, ICICI Bank personal loans cater to a wide range of financial needs, including quick cash flow through pre-approved loans disbursed in just 3 seconds.

Here’s an in-depth look at ICICI Bank’s personal loan offerings, eligibility criteria, interest rates, and more.

Why Choose ICICI Bank Personal Loan ?

ICICI Bank stands out for its diverse personal loan products and customer-centric features :

- Competitive Interest Rates : Starting at just 10.85% p.a.

- High Loan Amount : Borrow up to ₹50 lakh based on eligibility.

- Flexible Tenure : Choose a repayment term between 1 to 6 years.

- Quick Approvals : Pre-approved loans for select customers within seconds.

- Balance Transfer Facility : Transfer existing loans to ICICI Bank at lower rates.

- Overdraft Option : Salary account holders can access short-term funds via FlexiCash.

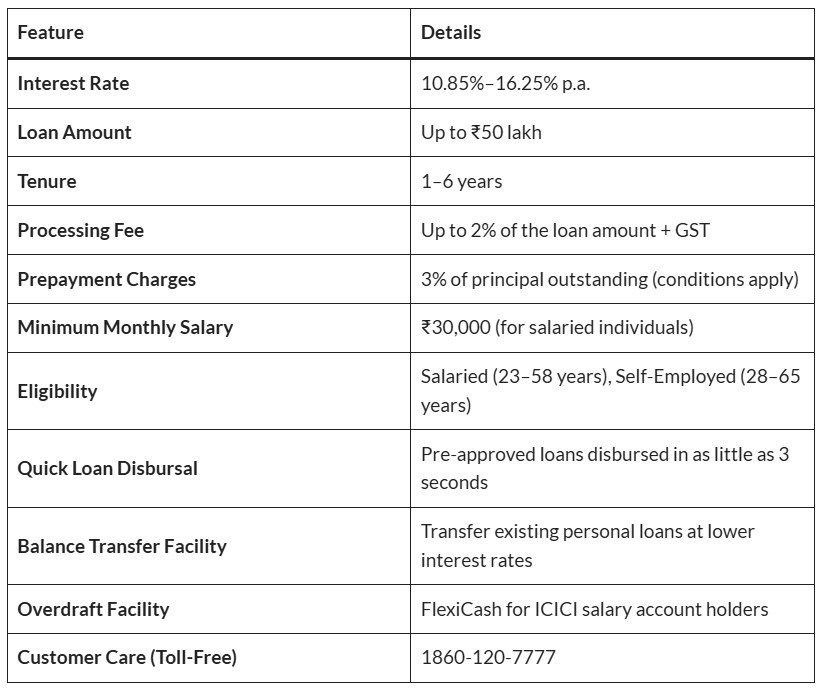

ICICI Bank Personal Loan Highlights

- Interest Rates: 10.85%–16.25% p.a.

- Loan Amount: Up to ₹50 lakh

- Tenure: 1–6 years

- Processing Fee: Up to 2% of the loan amount

- Minimum Monthly Salary: ₹30,000

- Prepayment Charges: 3% of the principal (after first EMI), with conditions for waivers.

ICICI Bank Personal Loan : Key Highlights Table

Types of ICICI Bank Personal Loans

1. ICICI Bank FlexiCash

- Purpose: Short-term credit for salary account holders.

- Processing Fee: ₹1,999 + taxes.

2. Personal Loan for NRIs

- Loan Amount: Up to ₹10 lakh.

- Tailored for the financial needs of Non-Resident Indians.

3. Pre-Approved Personal Loan

- Loan Amount: Up to ₹50 lakh.

- Tenure: 1–5 years.

- Available for select ICICI Bank customers.

4. Personal Loan Top-Up

- Loan Amount: ₹50,000–₹25 lakh.

- Purpose: Additional funds on an existing loan.

5. Balance Transfer Facility

- Benefits: Lower interest rates when transferring loans from other banks or NBFCs.

6. Fresher Funding

- Loan Amount: Up to ₹1.5 lakh.

- Designed for new employees and freshers.

ICICI Bank Personal Loan Interest Rates

| Loan Product | Interest Rate (p.a.) |

| Standard Personal Loan | 10.85%–16.25% |

| FlexiCash Overdraft | 12.35%–14.10% |

| Personal Loan for NRIs | 10.80% onwards |

Eligibility Criteria for ICICI Bank Personal Loan

For Salaried Individuals

- Age: 23–58 years.

- Monthly Income: ₹30,000 minimum.

- Work Experience: At least 2 years.

- Residence Stability: Minimum 1 year at the current address.

For Self-Employed Individuals

- Age: 28–65 years (25 years for doctors).

- Business Turnover: ₹40 lakh (non-professionals) or ₹15 lakh (professionals).

- Profit After Tax: ₹2 lakh for proprietors; ₹1 lakh for non-professionals.

- Business Stability: 5 years, or 3 years for doctors.

Documents Required

For Salaried Individuals

- Identity Proof: PAN, Passport, Driving License, or Voter ID.

- Address Proof: Utility bill, Rent Agreement, or Passport.

- Income Proof: Last 3 months’ salary slips and bank statements.

For Self-Employed Individuals

- KYC Documents: PAN, Aadhaar, or Passport.

- Business Proof: Office ownership documents or rent agreement.

- Income Proof: Audited financials, bank statements for 6 months.

ICICI Bank Personal Loan Charges

- Processing Fee: Up to 2% of the loan amount + GST.

- Prepayment Charges: 3% on the outstanding principal (conditions apply).

- Loan Cancellation: ₹3,000 + GST.

- Penal Interest: 24% p.a.

- EMI Bounce Fee: ₹400 + GST per instance.

ICICI Bank Personal Loan EMI Calculator

Use the EMI Calculator to estimate your monthly repayments:

- Loan Amount: ₹5,00,000

- Interest Rate: 10.85% p.a.

- Tenure: 5 years

- Monthly EMI: ₹10,746.95

- Total Repayment: ₹6,44,817 (includes interest).

How to Apply for ICICI Bank Personal Loan

- Online: Apply via the ICICI Bank website or iMobile Pay app.

- Branches: Visit your nearest ICICI Bank branch.

- Third-Party Platforms: Use platforms like Paisabazaar for comparisons and applications.