Friends, as you all know that in today’s time PAN card is a very important document. Income Tax Department has mainly entrusted the work to “Protean eGov Technologies Limited” for online application of PAN Card. Apart from this, “UTI Infrastructure and Services Limited” (UTIISL) has also been appointed by the IT Department for the application of PAN card. Applying online for PAN card in India has now become very simple and easy. To fill online PAN card form just click on “Apply” button given below and then follow all the required steps.

Use the internet to apply for a new PAN card. The cost to apply for PAN card is Rs. 862 for Indian address (except Goods and Services Tax) and for foreign communication address. You can also pay the application fee using credit/debit card. “Protean”(formerly NSDL eGov)/ UTITSL will process your PAN application.

If you have not received your PAN card yet, then this article is going to be very important for you. Now that you have understood the importance of PAN card, you can apply for it online sitting at home, for this you will have to read this article till the end. You will be provided with complete information about required documents, importance of PAN, eligibility criteria, application fee and application process.

Importance of PAN Card

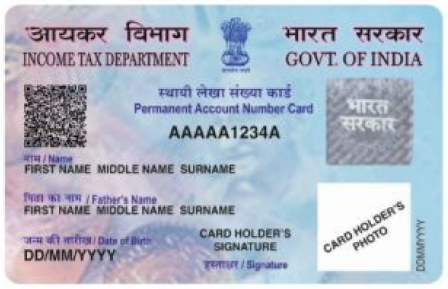

The Income Tax Department of the Government of India issues PAN card. PAN card is issued to any Indian citizen only once in his lifetime. If PAN card is lost then you can apply for a new one. PAN cards are made not only for individuals but also for businesses, departments, government entities, ministries and institutions.

In the eyes of the government, PAN card is a means of measuring or understanding the income of a person. It is an important document while paying tax. And it is necessary to have PAN card number for tax payment and financial investments.

PAN Card number consists of total 10 digits, which include 6 English letters and 4 digits. It contains all the tax and investment related information of the person. Apart from this, credit score is also checked using PAN card.

Documents Required for Online Apply PAN Card

- Residence certificate

- Identity card

- Email ID (mandatory)

- Aadhar card

- Bank account number

- Two passport-size photographs

- Demand Draft of Rs 107 as the fee

- If applying abroad, make a Demand Draft of Rs 114 for the given address.

Benefits of Pan Card

If you withdraw or deposit Rs 50,000 from your bank, you will not need to provide any other document. You can complete the transaction using your PAN card number. Here are some other uses of PAN Card :-

- Income Tax Return :- PAN card is also used to fill Income Tax Return.

- Money Transfer :- Using PAN card you can easily send money from one account to another.

- Shares Trading :- PAN card can be used to buy and sell shares.

- TDS Transactions :- PAN card can be used to deposit and withdraw TDS.

- Bank Account Opening :- With the help of PAN card, you can easily open your account in the bank.

Certificates Required to Make PAN Card

- Passport of the applicant

- Identity card of the applicant

- Electricity bill

- Ration card of the applicant

- Driving license

- Property tax certificate of the applicant

- High school certificate of the applicant

- Credit card details

- Bank account details

- Depository account details

Fees for Applying PAN Card

- The application fee for PAN card is Rs 107.

- Candidates can easily pay the fee by cheque, credit card or demand draft.

- Demand draft should be payable at Mumbai. It is very important to have the applicant’s name and acknowledgment number on the back of the demand draft.

- If you are paying through demand draft or cheque, then you will have to make the check in the name of NSDL-PAN.

- Candidates who will pay by check can make the payment in any branch of HDFC Bank.

- Mention “NSDL PAN” as deposit slip details

How to Apply Online for PAN Card in 2024

Candidates wishing to apply online for PAN card can do so by visiting the official website. The complete online application process is explained below, and you can register by following these steps :-

- Visit the Official Website of the Income Tax Department www.pan.utiitsl.com.

- Open the form provided on the website.

- Click on “Apply Online.”

- Choose “New Pan-Indian Citizen (Form 49A)” as the Application Type.

- Select your title in the Application Information section.

- Enter your last name, first name, middle name, date of birth, email ID, and mobile number.

- Enter the Captcha code.

- Click on “By submitting data to us and/or using.”

- Click on the Submit button to register for the PAN card.

- A token number will be sent to the email ID you provided.

- Click on “Continue with PAN Application.”

- Fill in the form step by step on the new page.

- Go to “Personal Details.”

- Choose how you want to submit your documents and select “Submit digitally through e.kyc & e-sign (paperless).”

- Move to the Aadhaar option and enter your Aadhaar number.

- Fill in your full name and select your gender.

- Provide details of your father’s name in the “Details of Parent” section.

- Move to the “Source of Income” section and select an income option.

- Enter details of your telephone and email ID, including Country Code, STD Code, Telephone, Mobile Number, etc.

- Click on “Next” and then click on “Save Draft.”

How to Check Pan Card Status Online ?

- Visit the official website of UTI.

- Retrieve your application coupon number or PAN number (if received).

- Enter the application coupon number or PAN number.

- After this enter your date of birth.

- Click on “Submit” button.

- Once you click on the “Submit” button, the status of your PAN card application will be displayed.