Today in our article we are going to discuss a very important topic, that is how to check your TDS online yourself. Many people do not even know about TDS. TDS is deducted from their salary, but they do not know how much TDS has been deducted.

So now there is nothing to worry about, if you also want to know how much TDS has been deducted from your salary, then there is no need to worry about it. Nor do you need to waste your time. You can check your TDS online while sitting at home. For complete information read this article completely.

What is TDS ?

Before telling the process of checking TDS, it is most important to tell that, what is TDS? Because many people have TDS deducted from their salary, but they are not aware what is TDS. The full name of TDS is TAX DEDUCTED AT SOURCE. According to the fixed rules of income tax, after payment of the fixed amount, some tax is levied on it. That means some part of your salary is deducted as tax.

This rule applies not only to salary, but also apply to your commission and your other sources of income. The money deducted as tax is deposited in the account through PAN card.

TDS Deduction Rules :-

According to the rules set by the Income Tax Department, in India, if you receive salary more than Rs 2.5 lakh, or if your pension is more than Rs 3 lakh, your TDS will be deducted. Even if your interest amount is more than 40%, your TDS is deducted. Along with this, the Income Tax Department has also said that TDS will also deducted on the amount won in any lottery or prize.

Even if you have many sources of income, but TDS is deducted from all the sources of your income. Even if you withdraw your provident fund before 5 years then 10% TDS is still deducted.

Even before you receive your money, TDS is deducted from it, and the TDS money is given to the government. If your income does not fall in the income tax slab decided by the government, yet TDS is deducted from you, then you can get your money back through ITR File. For this you need to know how much of your money has been deducted. If you want to know how much TDS is being deducted and when, then read our article till the end. In this article, we have explained in very simple language how you can check your TDS amount.

Method to Check Your TDS Amount :-

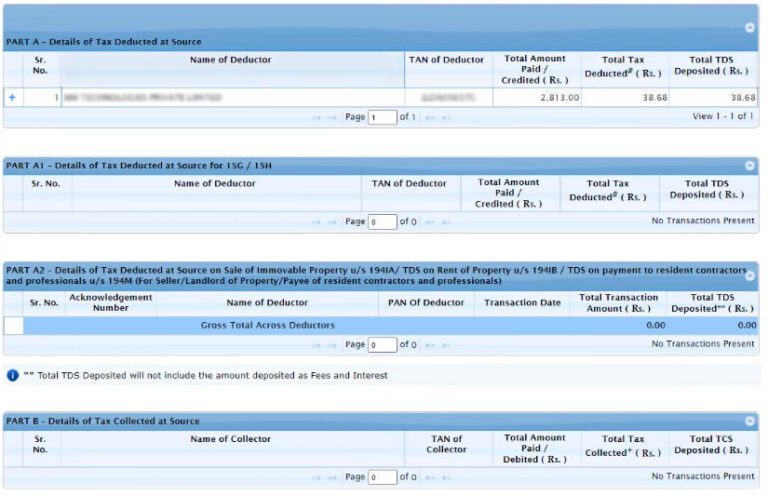

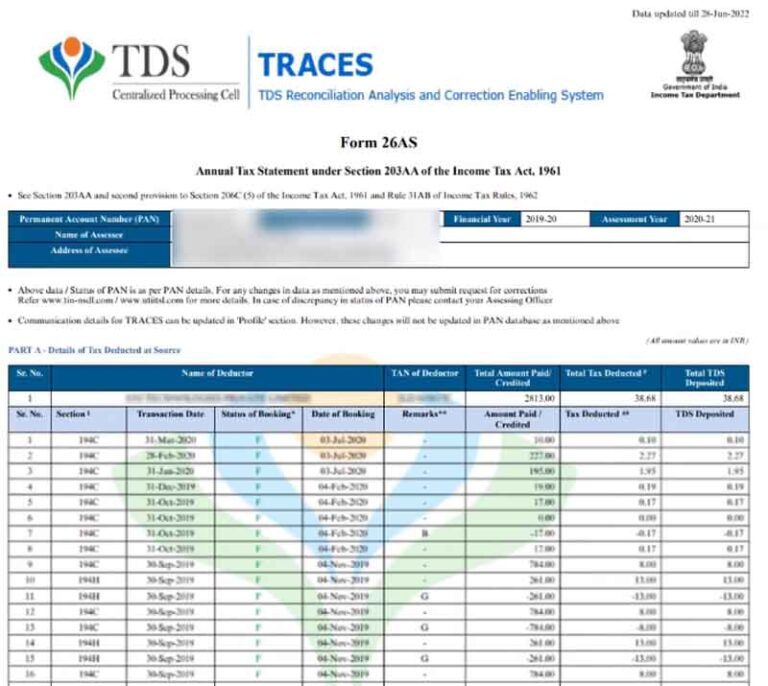

26AS is a form which provides information about how much TDS has been deducted and how much tax has been deposited. You can directly download this form by visiting the website of the Income Tax Department, and check your TDS online yourself sitting at home.

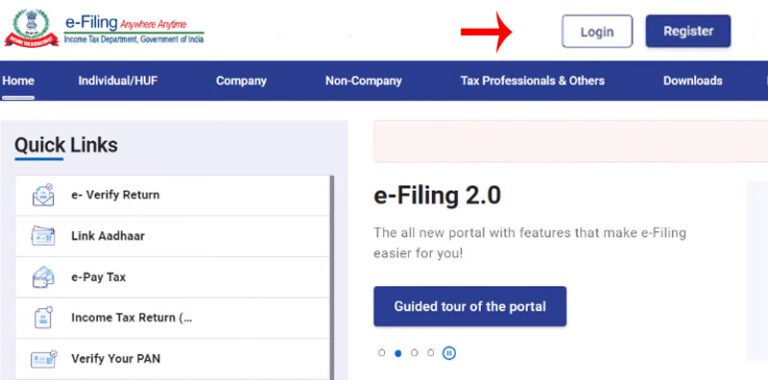

- Step 1:- First of all go to the Income Tax website www.incometax.gov.in. On the upper right side of the website, you will see the option of Register. Click there and first register yourself on the website.

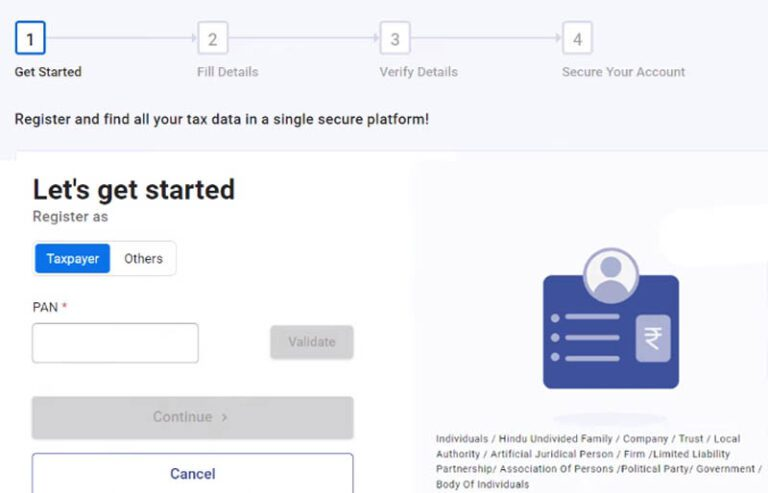

- Step 2 :- To register, you will need your PAN card. After filling the details based on that, OTP and password will be send on your email.

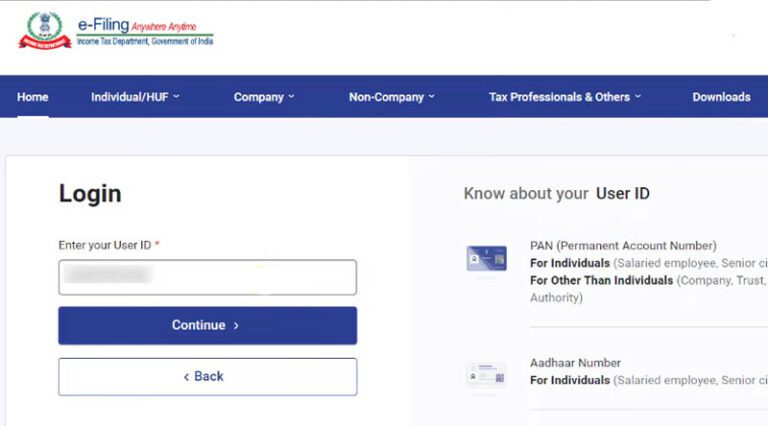

- Step 3 :- After registering, login to the website by entering your user ID and password.

While logging in, you have to use your Aadhaar number or PAN number or in place of user ID.

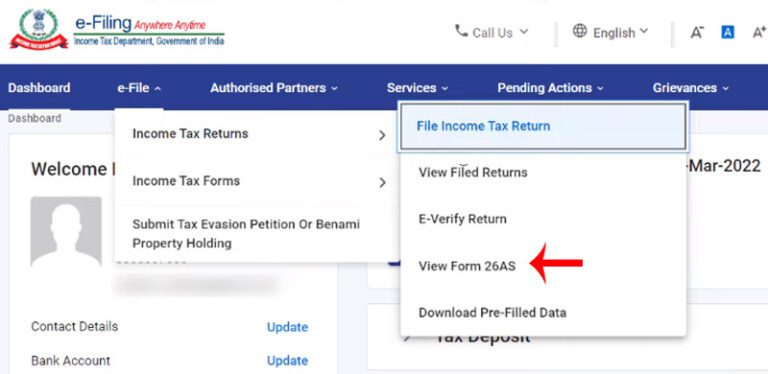

- Step 4 :- After logging in to the website, you will see many options at the top, out of which you have to select the option of e-File and from the option of this file, select the option of Income Tax Returns. After selection, you will see the option of View Form 26AS. Click on that option.

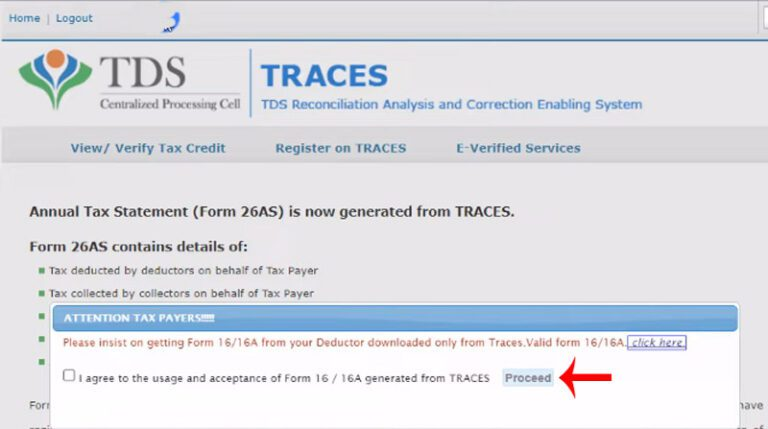

- Step 5 :- Select Disclaimer and click on Continue option. TDS website will open in front of you. Click on the check box and click on Proceed option.

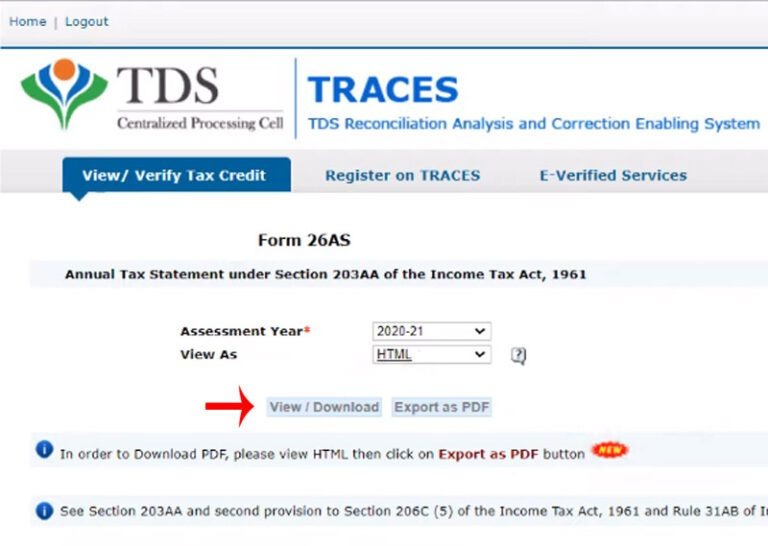

- Step 6 :- Now click on the option of View Tax Credit (Form 26AS) shown below.

- Step 7 :- Select the year for which you want to view the file (Assessment Year). And also select the type in which you want to view the file. And click on the option of view/Download.

Your file will be downloaded as soon as you click. After that some information will appear in front of you and below in Part A you will get a list of the company which has deducted your TDS. And also you will get to see how much TDS has been deducted and when it has been deducted.

- Step 8 :- If you want to download this entire report in PDF, then you have to click on the Export as pdf option given on the same page and your TDS report will be downloaded in PDF.

In this way you can easily check your TDS yourself sitting at home.